Editor’s Note: NGI’s Mexico Gas Price Index, a leader tracking Mexico natural gas market reform, is offering the following column by Eduardo Prud’homme as part of a regular series on understanding this process.

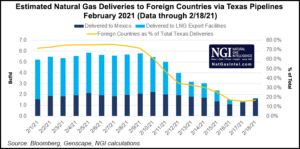

Texas gas exports

Prud’homme was central to the development of Cenagas, the nation’s natural gas pipeline operator, an entity formed in 2015 as part of the energy reform process. He began his career at national oil company Petróleos Mexicanos (Pemex), worked for 14 years at the Energy Regulatory Commission (CRE), rising to be chief economist, and from July 2015 through February served as the ISO chief officer for Cenagas, where he oversaw the technical, commercial and economic management of the nascent Natural Gas Integrated System (Sistrangas). Based in Mexico City, he is the head of Mexico energy consultancy Gadex.

The opinions and positions expressed by Prud’homme do not necessarily reflect the views of NGI’s Mexico Gas Price Index.

Mexican citizens abruptly learned over the past week that the smooth functioning of daily life relies on imports of natural gas from the southern United States. The recent power outages and gas shortages are some of the most serious in recent Mexican history. The fallout, analysis and political ramifications of the Texan energy crisis will drag on over the coming months and even years.

The connectivity between Texas and Mexico is so extensive and widespread that their gas and electricity markets are almost symbiotic. Northern Mexico experienced the effects of freezing temperatures to a large extent the way Texas did on Monday (Feb. 15) and Tuesday (Feb. 16). Similar to the Electric Reliability Council of Texas (ERCOT) system, power on Mexico’s National Interconnected System (SIN) was disrupted, and prices went through the roof. The nodal prices at various points exceeded 5,000 pesos/MWh, or $250/MWh, although the highest prices occurred in Baja California, with values above 10,000 pesos/MWh.

What we understood as normal in North American energy markets came crashing down. When natural gas prices started skyrocketing, most in Mexico didn’t understand the regional peculiarities of U.S. gas markets. In the blink of an eye, normally stubborn low single-digit prices reached the unimaginable figures of hundreds of dollars per MMBtu. On the night of Friday, Feb. 12, amazement gave way to a feeling of helplessness. There was not much to do but speculate on how state utility CFE would respond to those prices. Given that public service rates are regulated in a way that makes it difficult to transfer generation costs to users, it represented an enormous financial risk to the CFE subsidiary in charge of basic supply. President López Obrador had also promised not to raise the cost of energy. The logical thing to do would be to switch plants to fuel oil so that only a fraction of the generation mix supplied by CFE’s commercial arm would take the volumes committed in gas supply contracts.

But then the question became, what would happen to that expensive, contracted gas? Power system operator CENACE chooses what power to use based on costs, which would invariably leave gas plants out of the dispatch order. The probability of being left with the nominated fuel unused would be very high. This apparent paradox is rooted in one of the weaknesses of the current Mexican gas system: the inexistence of storage infrastructure capable of serving as a buffer for massive imbalances, and the absence of a liquid secondary market to allow surpluses to reach potential offtakers.

Until Friday, Feb. 12, the explanation for the increase in prices seemed to be the increase in demand in the central region of the United States. News of the Texas emergency had largely not gotten through. But throughout the ensuing weekend it became obvious that there would be restrictions on cross-border pipelines. With facilities exposed to extreme weather conditions, bottlenecks of varying severity were inevitable. On Monday, nervousness around the operating conditions of the import pipelines began to percolate. This, despite the fact that the amounts confirmed at the injection points in Camargo (Net Mexico Pipeline), Argüelles (Energy Transfer and Kinder Morgan Border) and Reynosa (Tennessee Pipeline) did not seem very far off from normal.

Power outages in the northeast of the country put the entire population on alert. Explanations soon began to appear not from CENACE, but from CFE. The message was concise: Texas shut the taps, we have no gas, there is no fuel to generate power. Certainly, restrictions were in place. But there was also the issue of price. The Railroad Commission of Texas had requested the application of priority criteria in the supply of gas to prioritize essential activities related to the safety and health of the population. But the gas nominated by other shippers had not suddenly disappeared. The shutting of the tap did not seem entirely credible. Or at least not at all points.

On Tuesday, the hope that the restart of activities in the United States after President’s Day would mean an improvement in operating conditions was soon dashed. The volumes confirmed on Ramones Phase I remained at half the capacity of the interconnection, and one-third below the average observed in recent months. Imports in the Reynosa-Argüelles area were down 30%. The size of the problem was evident. On Tuesday afternoon, pipeline operator Cenagas declared a critical alert.

This basically means that users were made aware of low gas volumes and that extractions throughout the national pipeline system Sistrangas would be adjusted according to the availability of natural gas and the nominations programmed by Cenagas for each user. It obliged users to adjust natural gas consumption by scheduling nominations through the MyQuorum Commercial System, in terms of a priority order determined by Energy Ministry Sener. Such measures were to take effect from the flow day of February 16, 2021, remaining in force until further notice. In other words, it affected intraday flows and did not necessarily reflect the proportionality of the cycles that had already elapsed. The wording of the announcement includes a priority system with a questionable legal basis. Among the list of users affected by the outages, neither CFE nor Pemex appear. The priority of Sener seems to imply a certain privilege aligned to public policy and the discourse of energy sovereignty.

Indeed sovereignty, and the vulnerability of the country by depending on Texas, soon became the topics of the day, including in the morning press events staged by President López Obrador. Criticisms of the energy reform, accusations of a lack of strategies, and allegations of the perversity of private initiative were the explanations for blackouts in the north and center of the country. Then Wednesday afternoon came, and the Governor of Texas ordered a halt to gas sales outside of Texas. It stunned all of us.

At the time of writing this column, operating conditions are still precarious, rotating outages continue, and the shutdown of industrial activities due to gas outages are significant. The expectation is that the weekend will give way to normal supply. But the end of the perfect storm will leave us feeling like a shipwreck with huge costs. The economic loss derived from the interruptions of power and gas supply will be significant. The financial losses that we will undoubtedly see due to the payment of electricity and fuel bills will be burdensome and will leave many small companies with the impossibility of complying with obligations. But the most significant loss will most likely be the reputational cost of the strategy that had Texas as the central supplier of energy in Mexico. No one will be able to again say that Mexico is lucky to have access to the cheapest gas in the world. Nobody will be able to affirm that supply is secure and that the market will prevail in the fulfillment of contracts. Nobody will be able to dismiss energy nationalism without hearing the counter arguments of this event. When talking about the reduction of the role of the state in the Mexican energy sector, many will refer to the intervention of Governor Abbott. The display of the weaknesses of the gas infrastructure in Mexico will be used to critique the market and blame the energy reform. It will become political, in other words. A lot of ink will run on it, certainly in this column. In the next one, expect me, with a few weeks of wisdom under my belt, to offer more.

0 Comments